Content

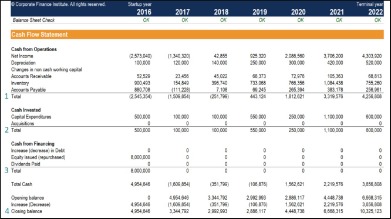

The goal of DCF analysis is to estimate the value of a business or investment by estimating the present value of all future cash flows. And the sum of just the first 25 years of discounted cash flows for this example is $784,286. In other words, even if the company went out of business a few decades from now, you’d still get most of the rate of return that you expected. The company doesn’t have to last forever for you to get your money’s worth.

What is the cash flow formula for DCF?

DCF Formula =CFt /( 1 +r)t

CFt = cash flow. It proves to be a prerequisite for analyzing the business's strength, profitability, & scope for betterment. read more in period t. R = Appropriate discount rate that has given the riskiness of the cash flows.

The value of the company equals the sum of the present values for all periods, one to infinity. With a lot of work, it is usually possible to come up with an acceptable estimate of next year’s cash flow. Each additional year becomes more difficult to estimate with an acceptable degree of accuracy. Discounted cash flow financial models are used as cash flow valuations to value and select investments.

DCF Formula (Discounted Cash Flow)

The internal rate of return is a metric used in capital budgeting to estimate the return of potential investments. A hurdle rate is the minimum rate of return on a project or investment required by a manager or investor. DCF analysis attempts to determine the value of an investment today, based on projections of how much money that investment will generate in the future.

- Often, analysts will use a business’ weighted average cost of capital , a required rate of return, or market averages.

- DCF models require detailed assumptions that are used to forecast future cash flows.

- The terminal value given by the formula is for a date in the future.

- The discount rate is the rate that future cash flows get discounted to their present value.

The TV often represents a large percentage of the total DCF valuation. Valuation, in such cases, is largely dependent on TV assumptions rather than operating assumptions for the business or the asset. The rate used to discount projected FCFs and terminal value to their present values. FCF is a measurement of profitability that eliminates these non-cash expenses and includes cash expenses for acquiring assets and changes in working capital over a given period of time.

Calculating WACC: An Example

It involves analyzing the value of a potential acquisition based on both the price paid and other factors such as expected synergies between the two businesses involved. Net Present Value is the difference between the initial cost of an investment and its present value. The DCF model can be used in capital budgeting, which is the process of making investment decisions.

- To answer this question, imagine that your company’s WACC is 5%, which means you’ll use 5% as their discount rate.

- Suppose you’re a financial analyst at a company, and you are recommending whether the company should invest in Project A or Project B.

- A grid-connected photovoltaic/biomass/wind system can provide a smaller LCOE than a grid-connected photovoltaic/biomass system.

- Instead the value calculated for i is compared with the cost of capital to see whether the project is profitable.

- The DCF model relies on free cash flow , which is a reliable metric that reduces the noise created by accounting policies and financial reporting.

- If you perform multiple valuations per year, and valuations are a significant part of the work you do, then using a tool that automates most of the process can make your life much easier.

It is analysis that can be applied to a variety of investments and capital projects where future cash flows can be reasonably estimated. Dividend discount models, such as the Gordon Growth Model for valuing stocks, are other analysis examples that use discounted cash flows. With XNPV, it’s possible to discount cash flows that are received over irregular time periods. This is particularly useful in financial modeling when a company may be acquired partway through a year. It is to be noted that when determining these net cash flows, expenditure items and income items are timed for the point at which the transactions takes place, rather than the time at which they are used.

What is discounted cash flow?

The discounted cash flow calculation can also be affected by using the wrong risk rate, also known as the discount rate. Investors use discounted cash flow as one method of analyzing potential stock investments and their estimated https://kelleysbookkeeping.com/ market value. Businesses often use their weighted average cost of capital rate as the risk rate to justify investment projects. Weighted average cost of capital is often used as the discount rate in a DCF model.

However, an accurate discounted cash flow value of an investment is dependent on accurate estimates, and this is not always possible. The discounted cash flow model can provide investors and companies with a far more accurate picture of the expected returns of an investment or project than relying on cash flow projections alone. The relative simplicity of the formula also allows analysts to quickly calculate the impact of different assumptions and Discounted Cash Flow Dcf Formula scenarios. Discounted cash flow valuation is differentiated from the accounting book value, which is based on the amount paid for the asset. Following the stock market crash of 1929, discounted cash flow analysis gained popularity as a valuation method for stocks. Irving Fisher in his 1930 book The Theory of Interest and John Burr Williams’s 1938 text The Theory of Investment Value first formally expressed the DCF method in modern economic terms.

The premise of the DCF model is that the value of a business is purely a function of its future cash flows. Thus, the first challenge in building a DCF model is to define and calculate the cash flows that a business generates. There are two common approaches to calculating the cash flows that a business generates. For each future cash flow at any time period in years from the present time, summed over all time periods.

How do you calculate DCF valuation?

- Project unlevered FCFs (UFCFs)

- Choose a discount rate.

- Calculate the TV.

- Calculate the enterprise value (EV) by discounting the projected UFCFs and TV to net present value.

- Calculate the equity value by subtracting net debt from EV.

- Review the results.